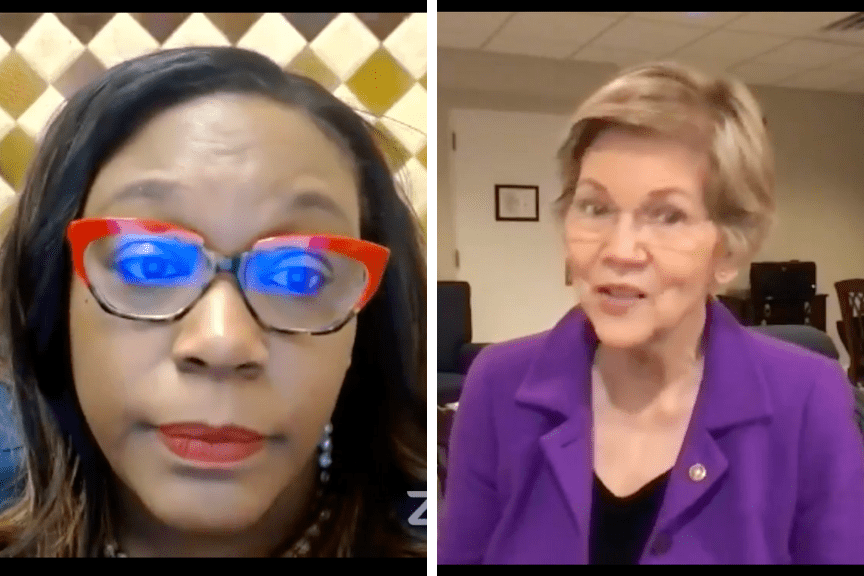

Philadelphia, PA — Councilmember Kendra Brooks (At-Large), joined by U.S. Senator Elizabeth Warren, D-Mass., today announced the introduction of the Philadelphia Wealth Tax—a municipal tax aimed at requiring the wealthiest Philadelphians with money held in direct stock and bonds to pay what they owe to fund a real recovery for working Philadelphians. The tax could bring in over $200 million to Philadelphia annually, according to an analysis done by PA Budget and Policy Center. The bill is co-sponsored by Councilmembers Helen Gym (At Large) and Jamie Gauthier (3rd District).

Philadelphia, PA — Councilmember Kendra Brooks (At-Large), joined by U.S. Senator Elizabeth Warren, D-Mass., today announced the introduction of the Philadelphia Wealth Tax—a municipal tax aimed at requiring the wealthiest Philadelphians with money held in direct stock and bonds to pay what they owe to fund a real recovery for working Philadelphians. The tax could bring in over $200 million to Philadelphia annually, according to an analysis done by PA Budget and Policy Center. The bill is co-sponsored by Councilmembers Helen Gym (At Large) and Jamie Gauthier (3rd District).

Philadelphians, like residents in cities across the country, are struggling to cover basic costs: necessities like rent, child care, utilities, and food take up a greater and greater portion of take-home pay for most residents. Almost a quarter of Philadelphians—and 34% of Philadelphia’s children—live below the federal poverty line, the highest rate among the country’s 10 largest cities. The ultra-rich, on the other hand, are doing better than ever: Billionaires as a class grew their wealth by 57%—or $1.5 trillion—since March 2020. Philadelphia billionaires alone have made hundreds of millions of dollars, billionaires like Comcast CEO Brian Roberts, who grew his wealth by $200 million from 2020 to 2021, for a total of $1.9 billion.

“For far to long many of the ultra rich and powerful have rigged the rules in their favor,” said U.S. Senator Elizabeth Warren. “So much so now that the top tenth of the 1% pay a lower effective tax rate than the bottom 99% of Americans. As millions of families have been suffering financially because of the rising costs of everyday essentials, billionaires have actually seen their wealth double since the start of the pandemic. The tax system in America is broken, and it allows the rich and the powerful to make themselves richer and more powerful at the expense of working families.

“It’s time to put power back where it belongs—in the hands of working families. I’m in this fight all the way and delighted to have this chance to fight alongside you,” said Senator Warren.

Philadelphia has also seen widespread disinvestment in recent years—services slashed, city departments underfunded, and neighborhoods left with poor or unequal access. The residents bearing the brunt of this disinvestment, which has only worsened during the pandemic, are disproportionately from Black and Latinx communities. Federal funding through ARPA, which has provided a temporary stopgap, cannot meaningfully address the decades of disinvestment facing our communities.

“The pandemic lit the powder keg of structural racism and disinvestment ablaze” said Councilmember Kendra Brooks, who plans to introduce the bill in Philadelphia City Council this Thursday, March 31. “For decades now, Philadelphia has disinvested in working class Black and Brown neighborhoods like mine while giving tax breaks and hand-outs to big banks, developers, corporations, and the ultra-rich. The Philly Wealth Tax is our collective response to the status quo that has failed communities like mine for decades. This tax would lead the way in narrowing the racial wealth gap and creating a model for how public services can be sustainably funded in American cities.”

This wealth tax, the first bona fide wealth tax to be enacted in a major American city in decades, will be a model for cities nationwide to address the burgeoning inequality and poverty inflicted by the pandemic and decades of disinvestment. The Philly Wealth Tax would start to close the racial wealth gap and rebalance city spending, focusing it on the services and neighborhoods that need it most. This idea is popular among labor leaders and community activists who have been fighting for deep investments in city services for years. At the press conference, representatives from AFSCME DC 47 and AFSCME DC 33 expressed their support, in addition to Reverend Nicolas O’Rourke, Organizing Director for the Pennsylvania Working Families Party, Karen Harvey, leader with the Philadelphia Rent Control Coalition, and Brittany Alston of the Action Center on Race and the Economy.

“We have heard for years that libraries, recreation centers and mental health services couldn’t be funded properly because there just wasn’t enough money in the budget. We all know that this is about priorities. Raising more money from a wealth tax, making people who made so much money during the pandemic actually share that with other people who live in the city is something that is very important to our union,” said Cathy Scott, President of AFSCME District Council 47, which represents thousands of city workers in the library system, parks and recreation and more.

“Our city, like many across the country, has a long and appalling history of redlining and disinvestment, which has allowed some to thrive while low-income people and people of color have been cheated out of wealth for generations. We need to balance the scales and to do that we need to change the way that wealth is distributed. It’s long past time for the ultra wealthy to pay their fair share so we can fully fund city services and amenities and bring prosperity to working class communities,” said Councilmember Jamie Gauthier, a co-sponsor of the bill.

Philadelphia’s budget saw a $220 million shortfall from 2020 to 2021, including double-digit percentage cuts to the city’s homeless services, parks services, street cleaning, free libraries, and others. The estimated gains from the wealth tax of $200 million annually would be enough to fully fund, at a minimum, the city’s homeless services, library services, and parks department, per the 2021 budget.

This tax is also not a novel policy idea. It was law in Philadelphia and other counties across Pennsylvania until the 1990s, when several corporations, billionaires, and banks lobbied Philadelphia and other municipalities to get rid of the wealth tax. Similar taxes have been proposed in California and Washington state. The tax would enact a maximum rate of 0.4%, or $4 per $1,000 on the value of direct holdings in the stock market, excluding pensions, retirement accounts and checking and savings. For more technical information about the bill, please consult this analysis done by Pennsylvania Budget and Policy Center.

###