About The Commission

In February 2024, Philadelphia City Council approved Resolution #240108 to reconvene the Philadelphia Tax Reform Commission. The Commission has been charged with conducting a comprehensive analysis of Philadelphia’s tax structure, including state-imposed taxes, and providing recommendations on reforms to make it more inclusive, equitable, and growth-oriented.

Originally formed in 2002, the Commission’s last report was issued in 2003. With changing economic conditions and evolving fiscal challenges, this renewed effort includes an evaluation of past recommendations and exploration of new reforms for potential implementation in the Fiscal Year 2026 budget and beyond.

The 15-member Commission includes four members appointed by Philadelphia Mayor Cherelle Parker; four by Council President Johnson; one by City Controller Christy Brady; and one by each of the six local Chambers of Commerce in Philadelphia. The resolution was introduced by Councilmember Isaiah Thomas and sponsored by Council President Johnson.

Interim Report

The Philadelphia Tax Reform Commission released its interim report on Feb. 25, 2025 with priority recommendations to eliminate the BIRT tax burden, lower the wage tax rate to less than 3% to attract residents and jobs, and make targeted investments to supercharge business and job growth. The report, entitled “Jumpstarting Jobs: A Report on Investing in Tax Reform and Inclusive Strategies for a Thriving Philadelphia,” recommends strategies to make the city regionally and nationally competitive and ensure Philadelphia’s long-term prosperity.

Read the Philadelphia Tax Reform Commission's Interim Report

Richard Vague (Co-Chair) (Council appointment)

Richard Vague is a businessman and venture capitalist who served as the Secretary of Banking and Securities for the commonwealth of Pennsylvania from 2020 to 2023. Vague has authored a handful of books, most recently The Paradox of Debt. Vague holds various board positions, including serving on Penn’s Board of Trustees, Penn Medicine’s board, the Fund for the School District of Philadelphia and as the chair of the University of Pennsylvania Press.

Matt Stitt (Co-Chair) (Mayor appointment)

Matt Stitt works at PFM Group Consulting LLC as the managing director and national lead for equitable recovery and strategic financial initiatives for their Management and Budget consulting team. In this role he works with public sector leaders to plan structural changes, budget reforms and financial planning. Prior to his current role, Stitt served as the chief financial officer for the City Council of Philadelphia, where he led the annual review of the city’s multi-billion-dollar budget and strategic plans.

Paul Levy (Council appointment)

Paul Levy was the Founding President and Chief Executive officer of Center City District, serving in that role from 1991 to 2023. Paul also taught City and Urban Planning for various educational institutions, including the University of Pennsylvania, Temple University, and Columbia University.

Jovan Goldstein (Council appointment)

Jovan Goldstein founded JTGoldstein in 2011 and now serves as managing partner where he oversees the assurance, audit, and tax departments. Goldstein also serves as CFO of Philanthropi, a platform that makes online giving more accessible. Goldstein was elected chair of the African-American Chamber of Commerce in 2022.

Ryan Boyer (Council appointment)

Ryan Boyer is the business manager for the Philadelphia Building and Construction Trades Council, a coalition of over 50 unions working in Philadelphia’s building and construction trades. From 2015 to 2021, Boyer served as Board Chair of the Board of Commissioners that oversees the operations of the Delaware River Port Authority.

Folasade (Sade) Olanipekun-Lewis (Mayor appointment)

Sade Olanipekun-Lewis is currently the Vice President of Operating and Community Partnerships at Vantage Airport Group. She previously served as Chief Administration Officer for the Philadelphia International Airport, and prior to that as Chief Financial Officer for the City of Philadelphia. Previously, Sade served as Deputy Commerce Director for Finance and Administration for the City of Philadelphia and served as Chief Financial Officer for the School District of Philadelphia.

Jerry Sweeney (Mayor appointment)

Jerry Sweeney has served as President, Chief Executive Officer and Trustee of Brandywine Reality Trust since the company was founded in 1994. Before his current role, Sweeney was Vice President of LCOR Incorporated. Sweeney is currently the chair of the Schuylkill River Development Corporation, the Center City District Foundation, the King of Prussia Rail Coalition Advisory Committee, and the Philadelphia Regional Port Authority.

Gregory L. Segall (Mayor appointment)

Greg Segall is the Chairman and CEO of Versa Capital. Segall’s expertise is in distressed and “special situations” investing, in addition to strategy and performance improvement, business management and governance, corporate finance, and capital markets. Prior to Versa, Segall was a Managing Director at Sigoloff & Associates, Inc.. Segall is a board member of Philadelphia Gas Works and Co-Chair of the Mayor’s Business Roundtables.

Allan Domb (City Controller appointment)

Allan Domb is a former At-Large City Councilmember, candidate for mayor, and currently serves as the Broker and Owner of Allan Domb Real Estate. As a council member, Domb advocated for reductions to the business and wage taxes to help workers and small businesses. Domb currently serves as a board member for Committee of Seventy, Starr Restaurant Group, the Friends of Rittenhouse, and six various condominium associations.

Jennifer Karpchuk for The Chamber of Commerce for Greater Philadelphia

Jennifer Karpchuk is Chair of Chamberlain Hrdlicka’s State and Local Tax practice and she has more than a decade of experience representing people and companies in cases relating to taxation. Karpchuk currently serves as the Secretary and Treasurer of the Philadelphia Bar Association’s Tax Section and Local Tax Committee. She is also an appointed member of the Philadelphia Bar Association’s Tax Council.

Derek Green for the African American Chamber of Commerce of Pennsylvania, New Jersey, and Delaware

Derek Green currently serves as Special Counsel for Bellevue Strategies. Prior to this role, Green served as an at-large member of Philadelphia City Council from 2015 to 2022. In that time, he chaired the Committees on Finance and Disabilities and served as the Vice Chair of the Committees on Aging and Law and Government. Additionally, Green served as the Chair of the Philadelphia Gas Commission, President of the Democratic Municipal Officials, and President of the Pennsylvania Municipal League. He also served on the Boards of the Philadelphia Cultural Fund and the National Black Caucus of Local Elected Officials and the Executive Committees of the Democratic National Committee and the National League of Cities.

Victor Garrido for the Greater Philadelphia Hispanic Chamber of Commerce

Victor Garrido is the Managing partner of GG CPA Services and partner of Brian C. Greenberg and Associates. Victor Garrido and his partners provide professional tax and accounting services, among others, to individuals and small businesses. Victor Garrido has been recognized by Forbes as a 2025 Best in State CPA and a 2024 Top 200 CPAs in America honoree, plus he is also a CPA Practice Advisor 40 Under 40 recipient, underscoring his leadership and impact in the accounting and tax profession.

Daniel McElhatton for the Greater Northeast Philadelphia Chamber of Commerce

Daniel McElhatton currently leads the Law offices of Daniel P. McElhatton, a general practice firm specializing in litigation. McElhatton previously served as a Philadelphia Assistant District Attorney and then a member of City Council in the 90’s. McElhatton is also a founding member of the Philadelphia Board of Ethics.

Dr. Khine Arthur for the Asian American Chamber of Commerce of Greater Philadelphia

Dr. Khine Arthur served as President and CEO of the Asian American Chamber of Commerce of Greater Philadelphia from October 2021 to October 2023, and after a short leave, is now back in her leadership role. Dr. Arthur has a long history of entrepreneurship and community work. In 2016, Khine founded a skincare company that works to support women who had survived domestic violence and sex trafficking.

Zach Wilcha for the Independence Business Alliance

Zach Wilcha is the first Chief Executive Officer of the Independence Business Alliance, which serves as the LGBTQ+ Chamber of Commerce for Greater Philadelphia. In this role, Wilcha has led the effort to the grow the IBA’s membership and board and increase its diversity. Wilcha joined the IBA in 2015 as the organization’s Executive Director.

This section contains detailed analyses, charts, tables, and other information reviewed by the Commission and/or referenced in the Jumpstarting Jobs report.

Appendix A

The Pew Charitable Trusts – Philadelphia 2024: The State of the City (April 2024)

Appendix B

Opportunity Insights - Creating Opportunity in Philadelphia - An Economic Mobility Study from Opportunity Insights at Harvard University (October 2024)

Appendix C

Diverse Chamber Coalition of Philadelphia – Findings from Diverse Small Business Communities (November 2024)

Appendix D

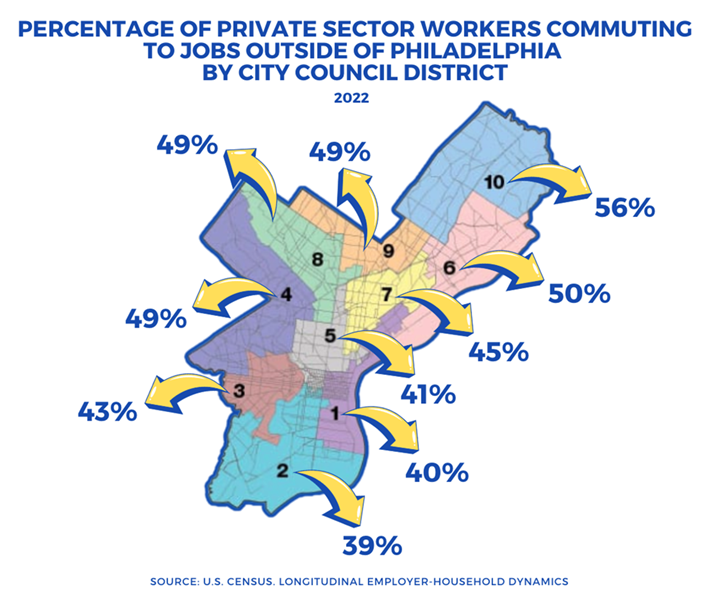

Commuting trends of private sector workers by City Council District

Appendix E

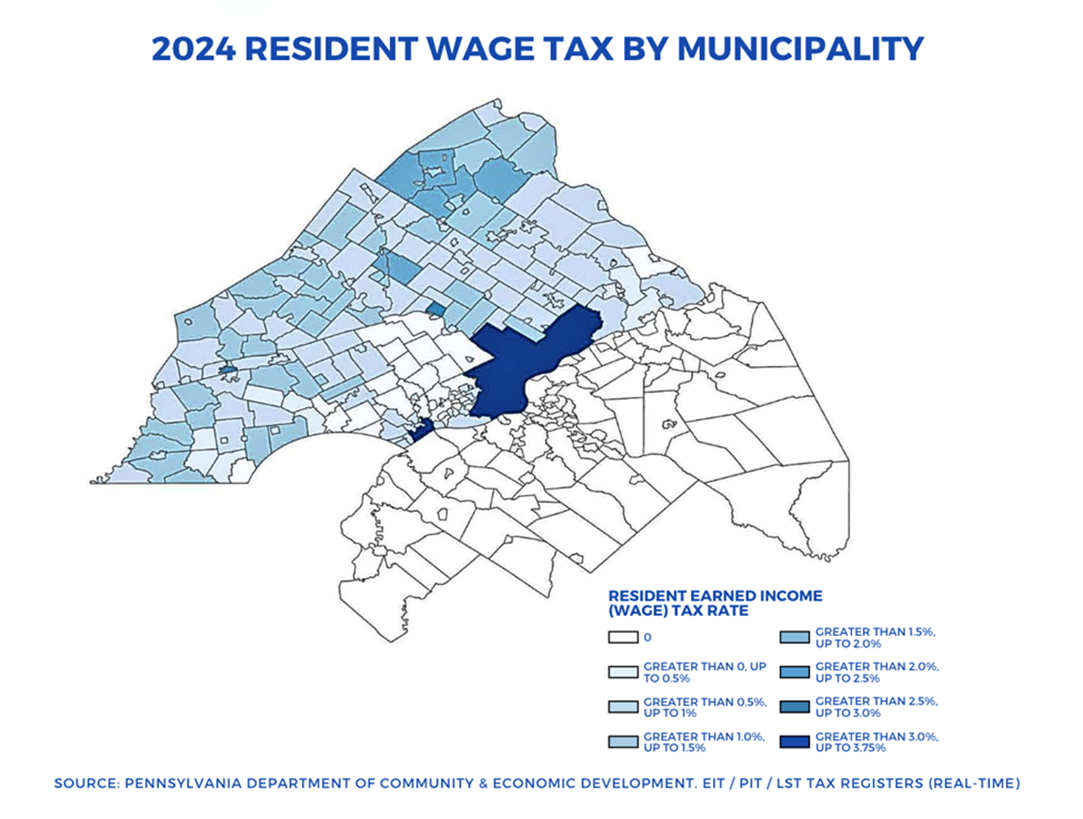

Comparison of wage tax rate for Philadelphia and the surrounding counties (2024)

Appendix F

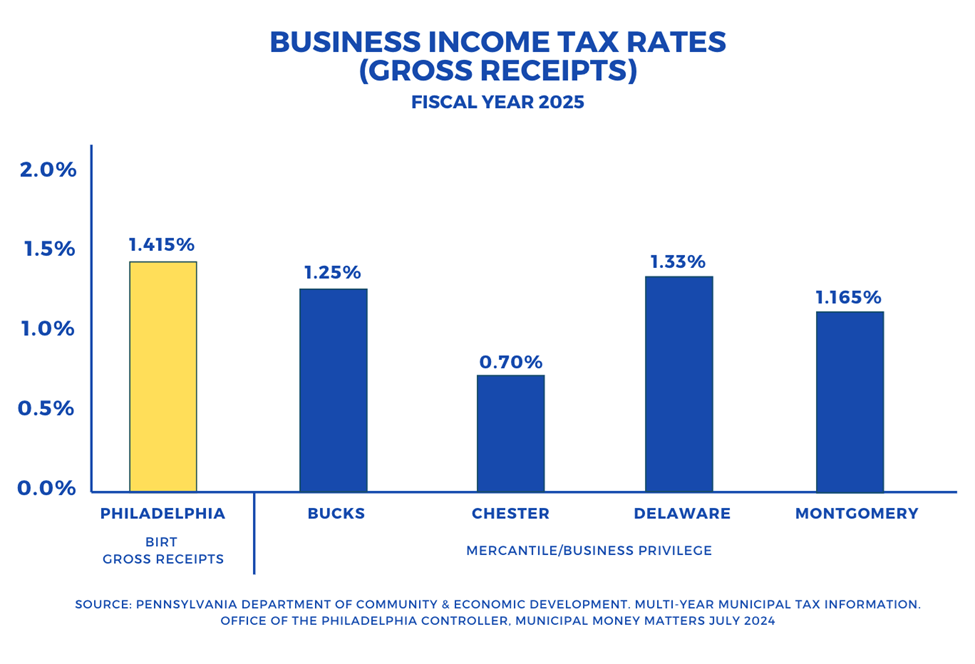

Gross receipts tax rate in Philadelphia compared with the surrounding counties

Appendix G

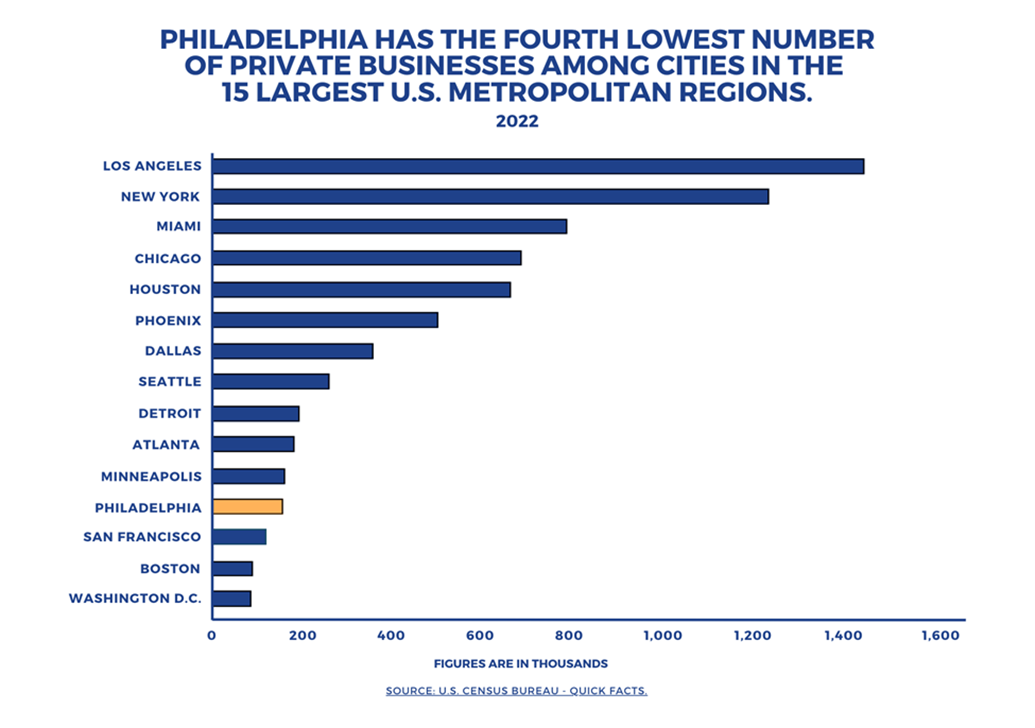

Private businesses in Philadelphia compared with cities in the 15 largest U.S. metro regions.

Appendix H

Econsult Solutions Inc. Tax Rate Scenario Analysis

Appendix I

BIRT and Wage Taxes - Three Tax Reform Options for City Council’s Consideration

Principle Conclusions and Recommendations

- The tax reform commission recommends the complete elimination of the net income portion of BIRT taxes.

- In addition, we recommend a program for wage tax reduction to achieve an eventual tax rate at or below 3%.

While there are many roads that city government may take to eliminate the net income part of the BIRT and reduce the wage tax, we are providing the following three examples of potential options or paths to achieve the goals we have set out. These scenarios show both the impact of tax reductions on the City budget and the faster job growth that can be achieved, based both on the City’s prior experience with more aggressive tax reduction from 1996 to 2008 and on economic modelling of the impact of reductions on the decisions of residents as to where they might live and of businesses as to whether they will expand or contract, hire new workers or leave the city. The more jobs and firms there are in Philadelphia, the more the City’s tax base grows, enabling more workers and businesses to pay lower rates but generate more tax revenues to support needed services.

Five-Year Revenue and Economic Impacts vs. Baseline by Scenario

Scenario 1: Low Impact Job Growth: 39,400; High Impact Job Growth 65,200

Scenario 2: Low Impact Job Growth: 31,200; High Impact Job Growth 51,500

Scenario 3: Low Impact Job Growth: 58,100; High Impact Job Growth 93,200

Scenario 1: BIRT Net Income elimination in 10 years and gradual reduction of resident and non-resident wage tax over the same period. Low Impact Job Growth: 39,400; High Impact Job Growth 65,200

|

FY25 |

FY26 |

FY27 |

FY28 |

FY29 |

FY30 |

FY26-FY30 Total |

|

|

BIRT Net Income Rate |

5.81% |

5.41% |

5.01% |

4.61% |

4.21% |

3.81% |

|

|

Amount reduced in dollars |

- |

-48,902 |

-83,925 |

-121,278 |

-160,957 |

-200,636 |

-615,698 |

|

NPT Impact |

7,335 |

12,589 |

18,192 |

24,144 |

30,095 |

92,355 |

|

|

Net BIRT NI reduction |

-41,567 |

-71,336 |

-103,086 |

-136,813 |

-170,541 |

-523,343 |

|

|

Resident Wage Tax Rate |

3.750% |

3.740% |

3.730% |

3.720% |

3.710% |

3.700% |

|

|

Amount reduced in dollars |

-43 |

-4,948 |

-10,216 |

-15,874 |

-21,947 |

-28,020 |

-81,005 |

|

Non-Resident Wage Tax |

3.44% |

3.44% |

3.44% |

3.44% |

3.44% |

3.44% |

|

|

Amount reduced in dollars |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Total Wage reduction |

-43 |

-4,948 |

-10,216 |

-15,874 |

-21,947 |

-28,020 |

-81,005 |

|

Total |

-46,515 |

-81,552 |

-118,960 |

-158,760 |

-198,561 |

-604,348 |

BIRT Net Income rate reduction schedule

- FY26-29 = -0.4%

- FY30-32 = -0.60%

- FY33-35 = -0.80%

Resident Wage Tax rate reduction schedule

- FY26-30 = -.01%

- FY31-35 = -.04%

Non-Resident Wage Tax rate reduction schedule

- FY26-30 = N/A

FY31-35 = -.02%

Scenario 2: BIRT Net Income elimination in 10 years and gradual reduction of resident and non-resident wage tax over the same period. Low Impact Job Growth: 31,200; High Impact Job Growth 51,500

|

FY25 |

FY26 |

FY27 |

FY28 |

FY29 |

FY30 |

FY26-FY30 Total |

|

|

BIRT Net Income Rate |

5.81% |

5.51% |

5.21% |

4.91% |

4.61% |

3.96% |

|

|

Amount reduced in dollars |

- |

-40,880 |

-67,299 |

-95,466 |

-125,377 |

-161,270 |

-490,292 |

|

NPT Impact |

6,132 |

10,095 |

14,320 |

18,807 |

24,191 |

73,544 |

|

|

Net BIRT NI reduction |

-34,748 |

-57,204 |

-81,146 |

-106,570 |

-137,080 |

-416,748 |

|

|

Resident Wage Tax Rate |

3.750% |

3.740% |

3.730% |

3.720% |

3.710% |

3.700% |

|

|

Amount reduced in dollars |

-43 |

-4,948 |

-10,216 |

-15,874 |

-21,947 |

-28,020 |

-81,005 |

|

Non-Resident Wage Tax |

3.44% |

3.44% |

3.44% |

3.44% |

3.44% |

3.44% |

|

|

Amount reduced in dollars |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Total Wage reduction |

-43 |

-4,948 |

-10,216 |

-15,874 |

-21,947 |

-28,020 |

-81,005 |

|

Total |

-39,696 |

-67,420 |

-97,020 |

-128,517 |

-165,100 |

-497,754 |

BIRT Net Income rate reduction schedule

- FY26-29 = -0.3%

- FY30-32 = -0.65%

- FY33-35 = -0.85%

Resident Wage Tax rate reduction schedule

- FY26-30 = -.01%

- FY31-35 = -.04%

Non-Resident Wage Tax rate reduction schedule

- FY26-30 = N/A

- FY31-35 = -.02%

Scenario 3 BIRT Net Income elimination in 5 years and gradual reduction of resident and non-resident wage tax to 2.99% over 10 years. Low Impact Job Growth: 58,100; High Impact Job Growth 93,200

|

FY25 |

FY26 |

FY27 |

FY28 |

FY29 |

FY30 |

FY26-FY30 Total |

|

|

BIRT Net income Rate |

5.81% |

4.65% |

3.49% |

2.32% |

1.16% |

0% |

|

|

Amount reduced in dollars |

- |

-109,874 |

-210,283 |

-318,311 |

-432,249 |

-546,187 |

-1,616,904 |

|

NPT Impact |

16,481 |

31,542 |

47,747 |

64,837 |

81,928 |

242,536 |

|

|

Net BIRT NI reduction |

-93,393 |

-178,741 |

-270,564 |

-367,412 |

-464,259 |

-1,374,368 |

|

|

Resident Wage Tax Rate |

3.75% |

3.67% |

3.60% |

3.52% |

3.45% |

3.37% |

|

|

Non-Resident Wage Tax |

3.44% |

3.40% |

3.35% |

3.31% |

3.26% |

3.22% |

|

|

Total Wage reduction |

-43 |

-50,491 |

-102,478 |

-160,570 |

-220,579 |

-280,588 |

-814,706 |

|

Total |

-143,884 |

-281,219 |

-431,134 |

-587,991 |

-744,847 |

-2,189,075 |

Appendix J

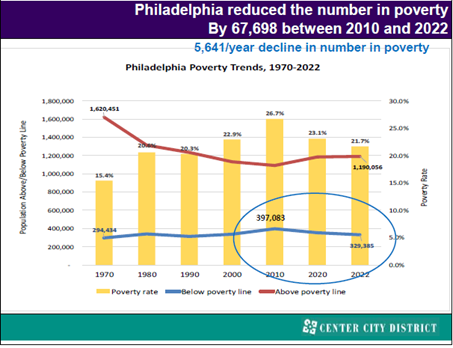

Job Growth and Poverty in Philadelphia

Appendix K

S&P - Overview of City of Philadelphia Revenue Forecast Process

Appendix L

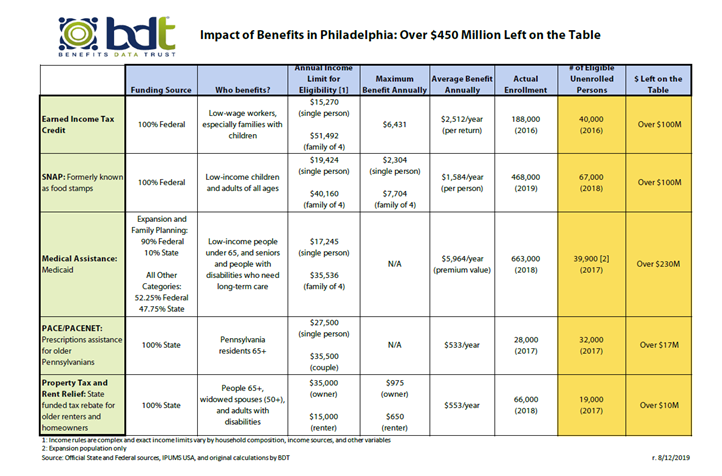

Impact of Public Benefits in Philadelphia: Over $450 Million Left on the Table

Appendix M

The Chamber of Commerce of Greater Philadelphia - Tax Reductions for Citywide Job and Business Growth

Appendix N

Municipal Money Matters from the City Controller - City Pension Obligations

Appendix P

Philadelphia City Council – Poverty Action Plan, Report of the Special Committee on Poverty Reduction and Prevention (March 2020)

Appendix Q

Center City District – Report: Lowering the Barriers to Inclusive Recovery (December 2023)

4ABC

AXIOS

BisNow

Hood Line

KYW

Metro Philadelphia

- Reform commission calls for elimination of business tax, wage tax cuts

- Your voice, your business: Why Philadelphia’s small business survey matters

Philadelphia Business Journal

- Philadelphia tax commission proposes $15 minimum wage, BIRT elimination

- Tax Reform Commission proposes 20-year tax abatement to boost office conversion projects

The Philadelphia Inquirer

- Changes could be coming to Philly’s tax structure. Here’s what you need to know.

- Mayor Cherelle Parker didn’t want to talk taxes in her first year in office. That’s about to change.

- Philadelphia’s business and wage taxes are hurting us all

- No tax on businesses? The Philadelphia Tax Reform Commission is calling for a major change

- What you need to know about the Philly business ‘double tax’ that some city leaders are trying to kill

- Philly is exploring a 20-year property tax abatement for converting struggling office buildings to apartments