From the desk of Lance Haver, Director of Civic Engagement for Philadelphia City Council.

The City of Philadelphia and the Commonwealth of Pennsylvania have several programs to help homeowners.

The Homestead Exemption

Every Philadelphian who owns the home where they reside can qualify for the Homestead Real Estate Tax Exemption, which reduces the taxable portion of their property assessment by $30,000. The Homestead Exemption applies only to the home of your primary residence, meaning you cannot receive it for any other property you own.

To apply, visit the Office of Property Assessment’s website.

Longtime Owner-Occupants Program (LOOP)

City Council created the Longtime Owner-Occupants Program (LOOP) for longtime resident homeowners who have lived in their homes for 10 years or more,experienced a significant increase in their property assessment from one year to the next, and meet income and other eligibility requirements. Homeowners whose LOOP applications are approved now will receive a tax discount in Tax Year 2017 and every year through 2023.

If you have questions about your eligibility for LOOP, call the LOOP hotline on Monday through Friday, 8:30 a.m. to 5:00 p.m., at 215-686-9200. Language translation services are available.

Application Deadline: February 17, 2017.

Senior Citizen Tax Freeze

Low-income senior citizens can take advantage of a tax freeze if they meet age and income requirements. Under the Senior Citizen Tax Freeze, the amount of property tax you pay each year will not increase, even if your property assessment or the tax rate changes. If your tax liability decreases due to a lower property assessment or a tax rate decrease, the amount of Real Estate Tax you owe will also be lowered to the new amount.

To receive the tax freeze, any of the following conditions must apply:

- A person aged 65 years or older;

- A person who lives in the same household with a spouse who is aged 65 years or older;

- A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away;

- Eligible applicant(s) will have a total income of:

- $23,500 or less for a single person; or

- $31,500 or less for a married couple

Real Estate Tax Deferment

If your Real Estate Taxes increase by more than 15% from the previous year, you might be able to postpone payment until the property is transferred or sold. The City will charge a minimum annual interest rate of at least 2%, and the deferred amount will also be subject to a lien.

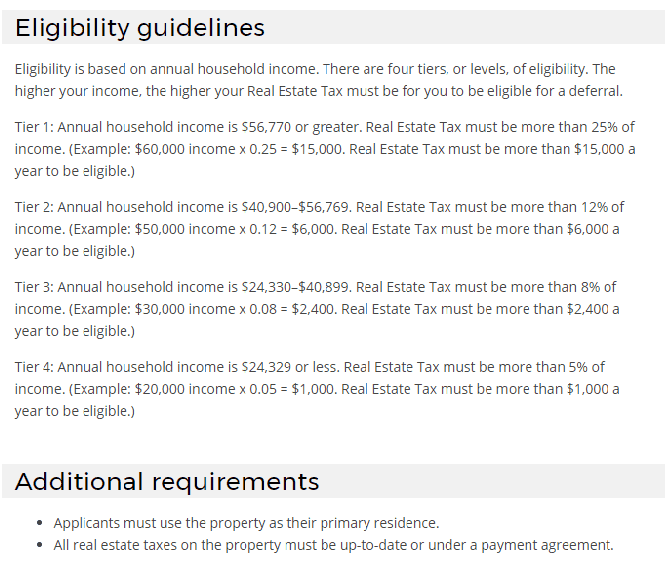

Eligibility is based on annual household income. There are four tiers, or levels, of eligibility. The higher your income, the higher your Real Estate Taxes must be for you to be eligible for a deferral. For more information, visit the program website.

Real Estate Tax Installment Plan

This program is for all senior citizens and some low-income taxpayers who own and live in their home. If eligible, you can pay your current-year real estate tax in monthly installments.

To apply, you must complete and mail in the current-year installment plan application, including all required information. Applications must be received by the end of March. If approved, you will receive a payment coupon book by the end of April, with coupons for eight required monthly payments. The first payment is due in May.

Already fallen behind on property taxes?

The City of Philadelphia offers a repayment plan for back taxes. The Owner-Occupied Real Estate Payment Agreement allows homeowners to make affordable monthly payments on property taxes that are past due. To be eligible, you must live in the home that you own. To stay eligible, you will be required to pay all new property taxes as they become due.

To apply, you must complete the Owner-Occupied Real Estate Payment Agreement form and other required documentation about your income and property.

The Commonwealth of Pennsylvania’s Property Tax/Rent Rebate

The Commonwealth of Pennsylvania offers a Property Tax/Rent Rebate Program for Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in 2015 and meet all other eligibility criteria.

The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975.

# # #

Follow Lance on Facebook and sign up to receive his newsletter to stay informed about this and other important issues.

Photo by R. Kennedy for GPTMC, used with permission.