COUNCIL PRESIDENT KENYATTA JOHNSON INTRODUCES RESOLUTIONS THAT WOULD RECONVENE THE PHILADELPHIA TAX REFORM COMMISSION AND CREATE A SPECIAL COMMITTEE ON CITY AND PRIVATE SECTOR DIVERSITY, EQUITY, AND INCLUSION POLICIES

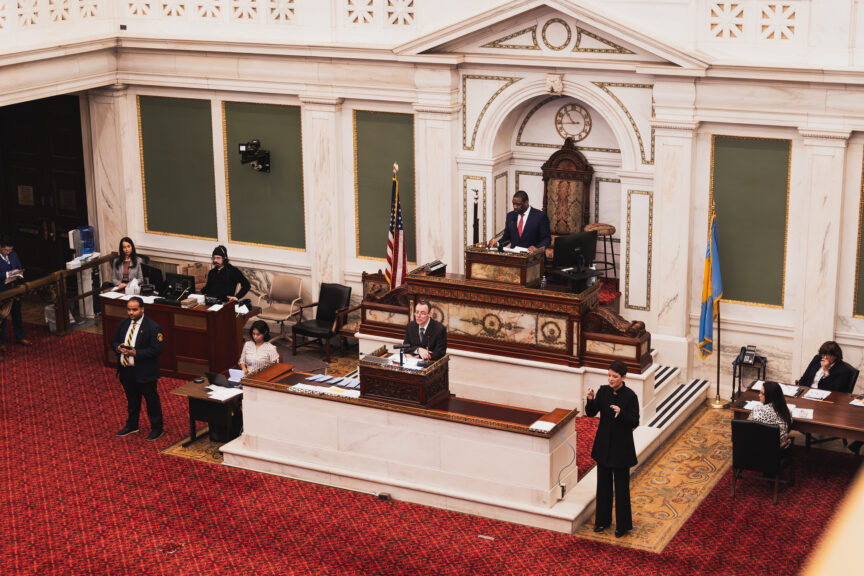

PHILADELPHIA, PA (February 15, 2024)—Philadelphia City Council President Kenyatta Johnson (Second District) introduced two (2) resolutions during today’s City Council session that will reestablish the Philadelphia Tax Reform Commission plus create a new Special Committee on City and Private Sector Diversity, Equity, and Inclusion Policies.

The resolutions were introduced by councilmembers on behalf of the Council President and are both scheduled for final approval during the February 22 Council session.

“During my Investiture Address at the City Council swearing in on January 2, I said we must reform our tax structure and regulatory environment to make our city more business friendly and economically competitive. In this post COVID19 Pandemic world we are in, it is important to reconvene the Philadelphia Tax Reform Commission to look at our various taxes in Philadelphia. We need a tax structure that encourages businesses to move into Philadelphia and, most importantly, stay in Philadelphia. I believe we can find a healthy and fair balance between providing tax relief for businesses, while also significantly investing in small businesses, which are the bedrock of our economy and our neighborhoods.”

The first resolution would reconvene the Philadelphia Tax Reform Commission and its Advisory Committee to conduct an updated comprehensive analysis of all taxes imposed in Philadelphia, including by the Commonwealth of Pennsylvania, and to make recommendations concerning tax reforms.

The original Tax Reform Commission was established in 2002 via Council Resolution #020264 and Bill #020255 and the Commission consisted of community and business leaders, the various local chambers of commerce, institutions of higher education, and trade organizations. The Commission was created to recommend methods to reduce taxes for Philadelphia residents, workers, and businesses.

The Commission issued its final report in 2003 and a summary of that report is available here.

It has been over 20 years since the original Tax Reform Commission issued its final report. During that time, policymakers have found it difficult and expensive to implement many of the recommendation reforms in the original report. Johnson believes a new Tax Reform Commission analysis is necessary to consider today’s socio-economic realities, including the uneven Post COVID19 Pandemic recovery among communities of color and the end of the federal COVID19 stimulus programs.

City Council can reestablish the new Philadelphia Tax Reform Commission because Section 4-900 (c) of the Philadelphia Home Rule Charter states that after the original Tax Reform Commission issued its report, the Commission shall be reconvened only as directed by a resolution of Council and adopted by a two-thirds vote (at least 12) of all members of Council and provided that the Tax Commission not be reconvened until at least five years has elapsed since the date the Commission adopted its last report.

Within 30 days after the adoption of this Tax Reform Commission resolution, the 15 members of the Tax Reform Commission shall be selected, according to Section 3-805 of the Home Rule Charter. Four members each are appointed by the Mayor and Council President, one member shall be appointed by the City Controller, and the remaining members (one each) are selected by various local Chambers of Commerce in Philadelphia.

The Commission’s Advisory Committee shall consist of 23 members appointed by a cross section of various community organizations in Philadelphia. If any organization ceases to exist or refuses to make an appointment, the members of the Commission shall by a majority vote designate an organization of a similar nature to make an appointment.

The second resolution would create City Council’s Special Committee on City and Private Sector Diversity, Equity, and Inclusion Policies, also known as DEI policies, to examine the impact of such policies and to provide practical, evidence-based recommendations to enhance City policy effectiveness in the promotion of minority, women-owned and disabled-owned business in Philadelphia.

“City government has an obligation to promote economic inclusion and equity for all,” President Johnson said. “The City of Philadelphia must have a focused analysis of the City’s DEI policies and procedures and those of the private sector as well. It is important that City leaders should make recommendations on how best to implement these policies to ensure that every resident and business has the necessary tools to thrive.”

While minority, women, and disabled-owned businesses (M/W/DSBEs) play a vital role in providing thousands of jobs in Philadelphia, vibrant commercial corridors, and revenue that directly supports City functions, disparities in opportunity and barriers to entry persist. The City of Philadelphia and some private sector participants have developed DEI policies, barriers still exist that prevent M/W/DSBEs from competing in our local economy.

The Special Committee’s duties would include, but not be confined to convening regular meetings for planning and coordination; tracking the City’s progress in addressing barriers for M/W/DSBEs; examining the efficacy of current programs and policies; identifying regional and national best practices; and holding public hearings to obtain public input.

The Council President would appoint the members of the Special Committee. The Special Committee would also submit a full report to the Council and the Mayor and make its findings and recommendations available to the public.

Philadelphia City Council President Kenyatta Johnson, a former state representative, serves Philadelphia’s Second Council District, which includes parts of Center City, South Philadelphia, and Southwest Philadelphia.